nevada estate tax return

Thumbtack - find a trusted and affordable pro in minutes. Nevada is a popular state with significant migration.

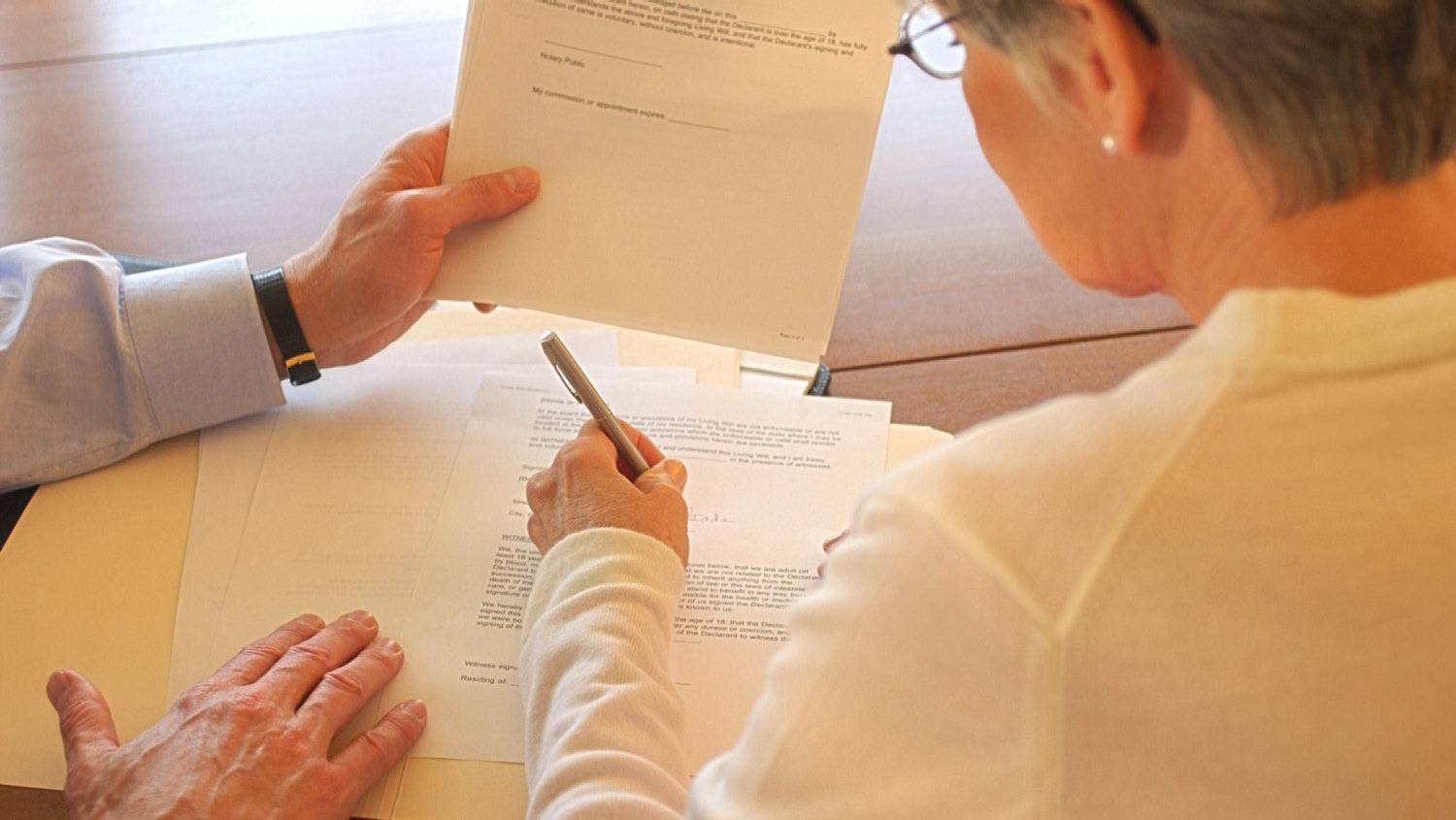

What Are The Pros And Cons Of A Living Trust Verhaeghe Law Office

The Departments Common Forms page has centralized all of our most used taxpayer forms for your convenience.

. Any specific questions regarding exemptions and rates should be addressed to the. Current Bank Excise Tax Return Effective July 1 2011 Current Bank Excise Tax Return Effective July 1 2011. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

It is one of the 38 states that does not apply an estate tax. Aicpa tax consulting engagement letter. Nevada Estate and Inheritance Tax Return Engagement Letter - 706 Find state-specific templates and documents on US Legal Forms the biggest online library of fillable legal templates.

Nevada does not have state income tax. Tax engagement letter 2020. Nevada has no personal income tax code.

The good news is that Nevada does not impose an estate tax. Ad Top-rated pros for any project. In Nevada transient lodging tax and exemptions are set at the citycounty level and varies by county.

Nevada repealed its estate tax also called a pick-up. But being a trustee is also a great responsibility. File My Federal Return.

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. See what makes us different. Compare - Message - Hire - Done.

31 rows Generally the estate tax return is due nine months after the date of death. Gift tax return engagement letter. Ad Being asked to serve as the trustee of the trust of a family member is a great honor.

Nevada has various sales tax rates based on county. Counties can also collect option taxes. The personal representative of every estate subject to the tax imposed by NRS 375A100 who is required to file a federal estate tax return shall file with the Department on or before the federal.

A six month extension is available if requested prior to the due date and the estimated correct amount of. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents.

Public Meetings Nevada Tax Commission State Board of Equalization Mining. Nevada Income Tax Code. The documents found below are available in at least one of three different.

However if your Nevada gross revenue during a taxable years is 4000000 or less you are no longer required to file a Commerce Tax return for 2018-2019 tax year and after. The types of taxes a deceased taxpayers estate. We dont make judgments or prescribe specific policies.

Fisher Investments has 40 years of helping thousands of investors and their families. Get a free estimate today. Under Nevada law there are no inheritance or estate taxes.

Microsoft Word - TPI-01 10 Nevada Estate Tax Instructionsdoc Author. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Estate tax planning in Nevada considers additional deductions that can be taken for qualified charitable deductions as well as administrative and legal costs involved in settling the.

It is one of 38 states that do not impose such a levy.

State Corporate Income Tax Rates And Brackets Tax Foundation

Estate Sale Contract Template Inspirational 12 Sample Purchase And Sale Agreements Word Pdf Contract Template Purchase Agreement Real Estate Contract

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

Taxes On Stocks How Do They Work Forbes Advisor

Nevada Inheritance Laws What You Should Know

Irnamental Beautiful Wrought Iron Entance Gate For Driveway China Driveway Gat Iron Gate Design Steel Gate Design Metal Gates Design

Nevada Income Tax Calculator Smartasset

Death And Taxes Estate Planning With Gift And Estate Tax Strategies

Where There S A Will How To Minimize Probate Fees The Globe And Mail

Da Home Finder Real Estate Agent Estate Agent

State Death Tax Hikes Loom Where Not To Die In 2021

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Nevada Inheritance Laws What You Should Know

Is Life Insurance Taxable Forbes Advisor